“We did not see the features we would expect to see in a well-run council.”

Hi {{ First name | there }},

The council finances scandal is back.

A new inspection report into Spelthorne borough council in Surrey found it had gambled more than £1bn of public money on property investments. Unable to cope with its debts, it’s now being taken over by government commissioners.

Gareth Davies, one of TBIJ’s longest-standing journalists, has been investigating local councils for years. He’s uncovered some of the most disastrous financial management you could think of and was the first to reveal the truly dramatic scale of Spelthorne’s debts seven years ago. The council now owes £10,000 for every person that lives in the borough, the second-highest debt per resident of any district authority in England, Gareth writes.

This is not just a Spelthorne problem, but a nationwide problem. But first, how did we get here?

When austerity brought cuts to council budgets across the UK, many tried to beef up their income by borrowing vast sums of money and investing in commercial property. The idea was that this would generate loads of rental income, which could go into public services. Spelthorne led the charge.

The problem was, as the inspection report puts it, Spelthorne paid little regard to long-term planning, risk management or how the property market might change. The council invested heavily in offices and a shopping centre – and then, of course, Covid-19 brought UK-wide lockdowns and long-lasting changes to office working.

“The council is in a critical financial position, burdened by unsustainable debt levels, significant investment risks, and systemic governance weaknesses,” the report said. “[Despite] mounting financial pressures, no clear path forward has been outlined.”

Now, Spelthorne needs to save £8.6m by 2028/29, about a third of its budget for the year.

The report points the finger squarely at council leadership. “Acquisitions were reportedly driven by a small group of councillors and officers, with insufficient consideration of potential risks and limited opportunities for effective challenge,” the inspectors wrote.

The council said that it’s doing its best to deal with the really difficult situation.

Long-time readers will immediately be reminded of another council: Thurrock.

Gareth also uncovered the Thurrock scandal, tracking down a man who made millions off council investments in a dodgy solar farm scheme, and then lived a life of off-the-charts opulence.

Both scandals speak volumes about local council finances across the country. There’s a rotten culture at play. After we’d exposed these deep-rooted issues, senior figures still told the Spelthorne inspection team that their own actions hadn’t put the council’s finances at risk – it was outsiders poking their noses in that posed the real danger.

Keir Starmer is planning a big reform of local government to place more power in the hands of residents. But while councillors and council officers remain resistant to any scrutiny, disasters will be inevitable.

Factchecked!

Each week we reveal a fascinating fact from our reporting…

Did you know?

The UK didn’t do any checks on EU meat imports at its border control posts for three years after Brexit.

Find out more

After the UK’s departure from the EU, Boris Johnson’s government announced that hygiene inspections on meat imports from Europe would begin in 2021.

However these checks were repeatedly delayed and weren’t implemented until 2024.

Trade policy expert Helen Buckingham told us that not a single check was performed during this period. As a result, hundreds of people, including children, were poisoned by imported meat during a series of major salmonella outbreaks.

Read more here.

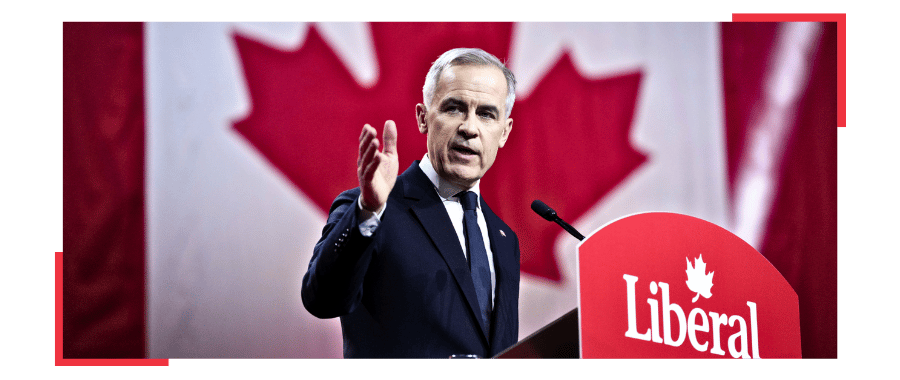

Can Carney keep his green credentials?

Canada’s new prime minister Mark Carney couldn’t have come in at a trickier time. Donald Trump’s threats of a trade war have created a completely unpredictable environment with Canada’s biggest trade partner and closest neighbour.

Electorally, it’s been a boon. Trump’s tariff threats have prompted a stunning revival for the prospects of Carney’s Liberal Party in upcoming elections. Under his predecessor Justin Trudeau’s leadership, the party was pretty much down and out.

But will Carney’s personal morals hold up under the strain of facing down Trump?

Here in the UK, Carney was best known as the last governor of the Bank of England (BoE). But he has also established himself as a champion for the environment. After leaving the BoE, he became the UN special envoy for climate action and finance.

He called for fossil fuels to be kept in the ground, warning they could become worthless in a low-carbon world. He also rallied international banks to make green pledges and avoid investments that could become “stranded assets” with little value.

But this is where the problems start, as our environment editor Rob Soutar has written. If Carney is going to fill the desperately-needed role of global leader fighting for net-zero commitments, then he’s got a lot of politics to get through first.

Just for a start, Canada is the world’s fourth largest oil producer. With the US threatening a 10% tariff on Canadian oil imports, Carney will be wary of disappointing his own business leaders. Promoting a green agenda may be undermined by his defence of Canada’s oil industry.

In his very first cabinet meeting, he seemed to strike a note of compromise, scrapping a carbon tax. It’s some distance from his radical approach five years ago.

With tariffs and difficult diplomacy looming, it’s hard to see Carney putting a climate agenda front and centre. But as we’ve exposed time and again, the risks to the planet are only growing.

Lord Sugar puts the BBC’s bleeper to work

Before I go, I couldn’t help but mention a prickly interaction between the BBC’s Amol Rajan and Lord Sugar during a programme broadcast during the week.

Sugar appeared as a guest on the Amol Rajan Interviews show, when Rajan mentioned our joint investigation with the Sunday Times into the businessman’s tax affairs (we revealed how he tried to avoid a £186m tax bill by becoming a non-resident for tax purposes).

Sugar’s response? “Total b*****ks”. Sounding a little irritated, he also said to Rajan, “I’ll show you the f*****g cheque mate.”

Check out the fiery moment on Instagram by tapping the above image.

What we’ve been reading

🔴 Badly built homes in London are bypassing treatment plants and pumping raw sewage directly into London’s rivers: londoncentric.media

🔴 A controversial facial recognition company tried to buy arrest records, including mugshots and email addresses: 404media.co

🔴 How Toronto-Dominion, or TD, became the go-to bank for money launderers working for criminal clients: bloomberg.com

Thanks,

Franz

Franz Wild

Editor